Dealerships

Overview

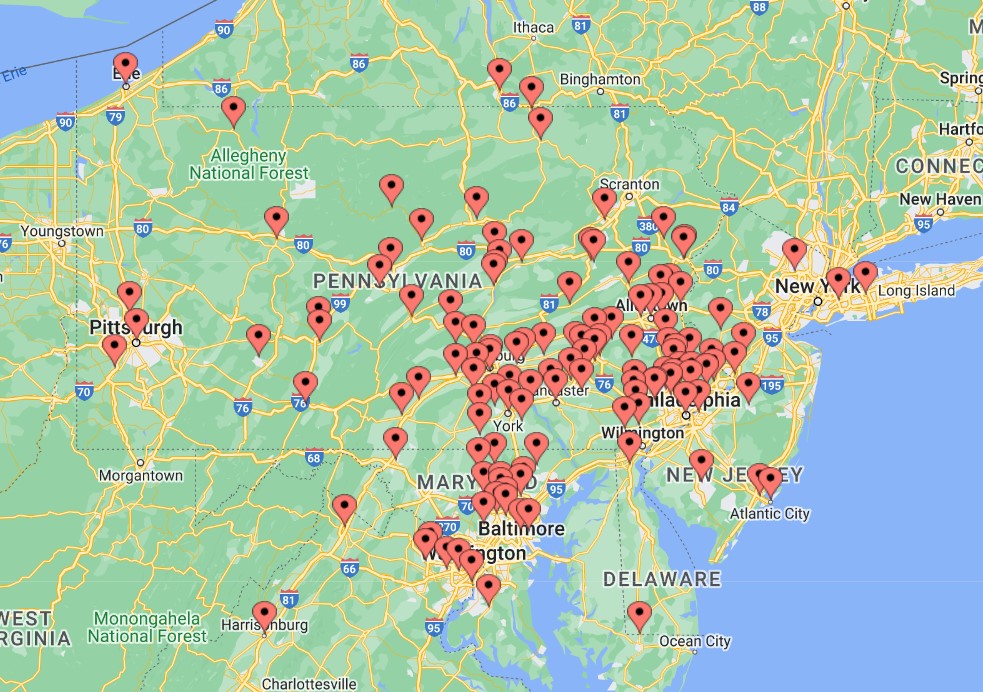

Boyer & Ritter understands the dealership world inside and out. We offer a regional presence, national reputation, and client-endorsed expertise to over 400 dealerships in the Mid-Atlantic region. Our experience, connections, and specialized knowledge uniquely position us to assist you in your success, overcome challenges, and highlight new ideas. No other firm can match our expertise in our market!

Pins represent one or more dealerships in a given location.

In addition to providing typical tax and financial reporting services, we often assist with valuations, acquisitions and sales, succession strategies, process improvement, and internal controls to name a few.

Boyer & Ritter's highly experienced team includes approximately 20 full-time dedicated professionals, including four who bring in-house dealership experience. We work closely with NADA and PAA on advocacy and education efforts impacting the industry. Additionally, Boyer & Ritter is a founding member of the AutoCPA Group, the oldest nationwide 20 Group of CPA firms specializing in servicing automobile dealerships throughout the United States and Canada (collectively representing approximately 2,000 dealers). Check out the AutoCPA Group newsletter, Headlights, as well as other articles impacting dealers in the tabs above.

Consulting Services We Offer to Dealerships Include:

- Operations Review Services

- Cost Segregation Studies

- Partial Asset Dispositions

- Tangible Property Regulations

- Business Valuations & Consulting

- Estate and Liquidity Planning

- Process Improvement and

Internal Controls - M&A including locating buyers and sellers

- Buy/Sells

- Payplans

- Deferred Compensation Plans

- Strategic Planning

- Litigation Support

Core Services To Dealerships:

- Independently Reviewed Financial Statements

- Income Tax Compliance & Planning

- Operational Consulting

- Budgets/Forecasts/Benchmarks

- LIFO Annual Computation

Annual Reporting Requirements in Pennsylvania

Starting in 2025, Pennsylvania requires all businesses and nonprofits registered in the state to submit an annual report to the Department of State. Requirements and due dates vary by entity type, and failure to file can result in penalties.

While this is not a service we provide directly, we want to ensure our clients and site visitors have the resources they need to understand and complete these filings.

Visit our Annual Reporting Resource Center for helpful links, filing guidance, and key deadlines.

Experience

Experience

- When state governments forced dealerships to close because of the COVID-19 pandemic, Boyer & Ritter immediately started working with NADA and the PAA to help dealers learn what government assistance was available. We realized dealers needed specific advice on how to apply and use crucial Payroll Protection Program loans. Partnering with a New England-based accounting firm, we created the “PPP Loan Forgiveness Workbook,” a free guide downloaded more than 50,000 times to date. The guide helps dealerships – and other businesses – not only obtain a PPP loan but also effectively use and track the money to maximize forgiveness.

- When the National Automobile Dealers Association (NADA) needed a subject matter expert to assist in educating the United States Congress on the role of floorplan financing in dealership operations and the potentially catastrophic impact a limited tax deduction could create, they called Boyer & Ritter to offer first-hand testimony and industry background to ensure the floorplan carve-out was included in the 2017 TCJA.

- When NADA needed a CPA firm to create “A Dealer Guide to the Tax Cuts and Jobs Act of 2017”, they called Boyer & Ritter to co-author the guide.

- When the Pennsylvania Automotive Association (PAA) was asking the Board of Vehicles in the Commonwealth of Pennsylvania to increase the maximum amount that a dealer in the state can charge as a doc fee, they called on Boyer & Ritter to prepare an independent analysis of the Estimated Costs to Comply with the relevant code section, resulting in a 171% ($245) increase to the doc fee for all dealers in the state.

-

We are a founding member of the AutoCPA Group, the oldest nationwide 20 group of CPA firms specializing in servicing dealerships throughout the United States and Canada (1,700+ dealers). In addition, we are active members in many industry associations, including Pennsylvania Automotive Association and Maryland Automobile Dealers Association. We are frequently asked by NADA to assist with advocacy projects on behalf of the industry.

News & Events

Articles

Events

News

Multimedia

Multimedia

View recordings of previous webinars.

Headlights Newsletter

Headlights Newsletter

Download PDF issues of Headlights, a seasonal newsletter publication produced by AutoCPA Group.

Boyer & Ritter is a founding member of the AutoCPA Group, the oldest nationwide 20 Group of CPA firms specializing in servicing automobile dealerships throughout the United States and Canada (over 1,700 dealers).

Headlights – NADA 2023 edition (PDF)

To request a printed copy of Headlights by mail, please email info@cpabr.com to be added to our mailing list.

Operations Review Services

Operations Review Services

Rebound Your Dealership's Profitability

Facing Profitability Challenges? You’re not alone. Compressed margins and increased expenses

are chipping away at your bottom line, potentially leading to net losses.

Our Solution:

- Maximize revenue opportunities by increasing volume.

- Align expenses and staffing for optimal efficiency.

- Leverage Finance and Fixed Ops to drive profitability.

Why Boyer & Ritter?

Boyer & Ritter understands dealerships. With over 400 clients regionally and our Auto Dealer BI reporting

product, we provide powerful insights by comparing your operational results to regional averages. Our

experienced staff analyzes your results to identify profit opportunities.

How we can help

Boyer & Ritter will provide a detailed analysis to help you identify and capitalize on profit opportunities.

Our services include:

- Comparative Analysis: Sales, Gross Profit, Expenses, and Net Profit.

- Gross Retention: Identify areas to retain more profit.

- Expense Benchmarks: Compare your expenses to industry standards.

- Fixed Operations Review: Maximize labor efficiency and retention.

- Productivity Models: Boost overall productivity.

- Profitability Budgeting: Develop financial stability models.

After the analysis, we will schedule a one-hour review call to discuss findings and action items.

Don't let declining profitability hold you back. Contact Stephanie Martz today schedule a one-hour review call and start maximizing your dealership’s profitability.

Contacts

- Jump to Paget. 717-761-7210 | Email

Professionals

- Jay A. Goldman

- Nathaniel J. Yost

- Rita Calamia

- Melissa Carter

- Mariya Cawley

- Jack Celmer

- Romulus C. Comly

- Charles H. Evans, IV

- J. Gregory Hamm

- Nicole Harmon

- Andrew Horst

- Joel C. Kreider

- Brian J. Kutz

- Stephanie Martz

- Jeremy D. Medernach

- Christopher M. Merkey

- Nate Moshgat

- Alexis Regester

- Jeremy J. Scheibelhut

- John Sterner

- Casey Surridge

- Thomas J. Taricani

- Jacqueline G. Yoder

- Geneka Zechman

Related Services

- Audit, Review, Compilation Services

- Business Tax Services

- Cost Segregation

- Employee Benefit Plan Services

- Estate Planning and Trusts

- Exit Planning and Readiness Assessment

- Fraud/Forensic Investigation Services

- Individual Tax Preparation and Wealth Management

- Litigation Support Services

- Mergers & Acquisitions

- Risk Management

- State and Local Tax

- Succession Planning

- Valuation Advisory Services