Do you need a professional business valuation?

By Scott A. Koman, CPA, CVA, CFE, MAFF

The need for accurate business valuation can arise from various situations—be it for transactions, legal disputes, or regulatory compliance. Regardless of circumstances, every business owner should know the value of their business. Understanding the value of your business is not just a matter of curiosity but a critical aspect of strategic planning and decision-making.

Is this something you can calculate on your own? Is a simple metric, like an earnings multiple, an appropriate way to calculate value? Do you need a professional business valuation?

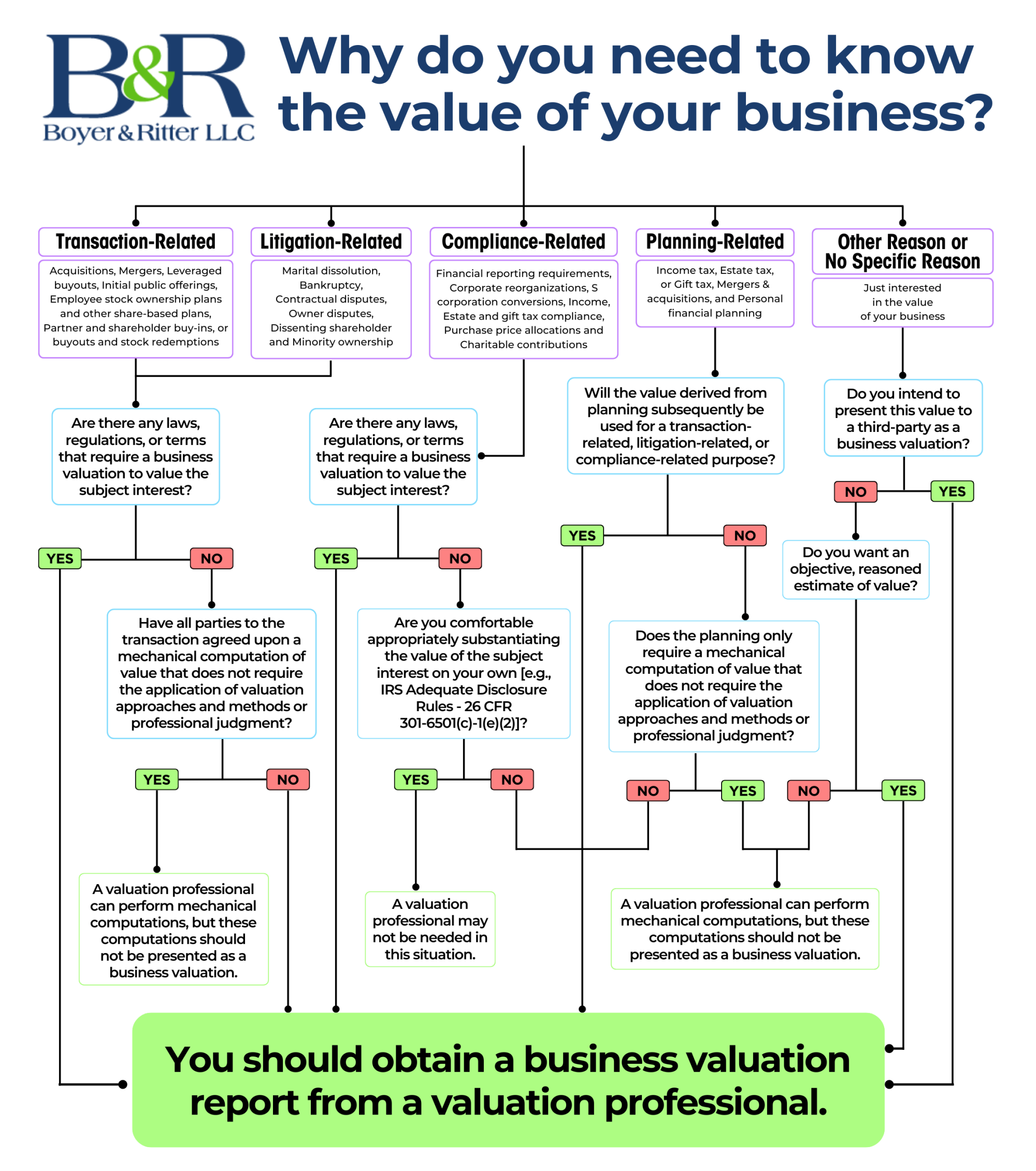

The interactive flowchart below will serve as your essential guide, offering a step-by-step approach to navigate through the complexities of business valuation, tailored to your unique circumstances and objectives.

Navigating the complexities of business valuation can be overwhelming, with each decision leading to increasingly complicated choices. Once you’ve established the need for a professional valuation, you must then decide on the type of report that best suits your situation—from a detailed written conclusion of value to a more succinct calculation of value. Ultimately, if you, or any third party, are seeking an objective, reasoned estimate of the value of your business, securing a business valuation report from a qualified valuation professional is imperative.

Our team holds professional designations such as Certified Valuation Analyst (CVA), as recognized by the National Association of Certified Valuation Analysts (NACVA), and Accredited in Business Valuation (ABV), as granted by the American Institute of Certified Public Accountants (AICPA). If you have any questions as to whether you should obtain a professional business valuation, please contact me or another member of our business valuation team.