New Year, New Letters from the IRS

Like clockwork, ringing in the new year also signifies the start of another tax filing season. The new year excitement passes, and days get longer for tax preparers everywhere. One difference this year, unlike the past two years, is the expectation the April deadline will not be postponed. For 2022, the filing deadline to submit 2021 tax returns or an extension to file and pay tax owed is Monday, April 18, 2022, for most taxpayers. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia. (Washington, D.C., holidays impact tax deadlines in the same way federal holidays do.)

Like clockwork, ringing in the new year also signifies the start of another tax filing season. The new year excitement passes, and days get longer for tax preparers everywhere. One difference this year, unlike the past two years, is the expectation the April deadline will not be postponed. For 2022, the filing deadline to submit 2021 tax returns or an extension to file and pay tax owed is Monday, April 18, 2022, for most taxpayers. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia. (Washington, D.C., holidays impact tax deadlines in the same way federal holidays do.)

So, what is actually new this year? As you await and begin to gather the various tax documents from your employer, business interests, banks and investment brokers, there are two new letters to be on the lookout from the IRS.

Advance Child Tax Credit Letter (Letter 6419)

Remember the monthly Advance Child Tax Credit payments issued to certain taxpayers from July through December? Recipients of these payments will receive Letter 6419, 2021 advance CTC. The IRS started sending this letter in late December and will continue to do so through January. Married taxpayers will each receive their own IRS Letter 6419. Be sure to keep both letters. This information is necessary to claim the remaining child tax credit and file an accurate tax return. Think of this letter as the same as any tax form, such as a W-2 or 1099. Do not throw it away!

Letter 6419 lists the total amount of advance Child Tax Credit payments received in 2021. It will also indicate the number of qualifying children used to calculate the monthly payments. Without the letter, the figures to be reported on your tax return for the additional child tax credit may not be accurate. This can result in delayed processing of your return and/or additional follow-up with the IRS.

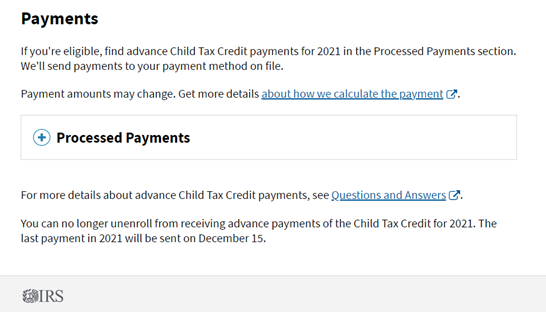

In addition to the paper form, this information is also available at the IRS Child Tax Credit portal. Click on View Advance Payments. Either sign in with an existing account or create a new ID.me account (requires photo identification and other personal information). Once logged in, eligible taxpayers should reference the “Processed Payments” section near the bottom under Payments.

In addition to the paper form, this information is also available at the IRS Child Tax Credit portal. Click on View Advance Payments. Either sign in with an existing account or create a new ID.me account (requires photo identification and other personal information). Once logged in, eligible taxpayers should reference the “Processed Payments” section near the bottom under Payments.

You may provide the detail under the Processed Payments section in lieu of the IRS Letter 6419.

Third Economic Impact Payment Letter (Letter 6475)

Remember the pandemic stimulus payments? The third round of payments was first issued in March and continued through the end of the year. Eligible individuals received $1,400 ($2,800 for married joint filers) plus $1,400 per qualifying dependent. For those who did not receive this payment in part or in full, you may claim the Recovery Rebate Credit on your 2021 tax return. You do not need to repay these monies if you no longer qualify to receive the payment based on your 2021 income.

The IRS plans to send Letter 6475 to claim the Recovery Rebate Credit in late January. To prevent processing delays or follow-up from the IRS, be sure to include Letter 6475 with your tax documents for your preparer.

Lastly, again this year, Boyer & Ritter is pleased to offer electronic tax return delivery through SafeSend Returns. In addition to providing clients with a simple, easy-to-use process for securely reviewing and e-signing their tax documents, this system helps to streamline communication between you and your tax preparer.

If you have any questions, contact any member of the Boyer & Ritter tax practice, or directly to your tax preparer.