GASB 87 impacts all lease accounting as of June. Are you ready?

Starting with fiscal years beginning after June 15, 2021, counties, municipalities, and school districts under GASB 87 will soon begin to account for most leases longer than 12 months on the front of the balance sheet, the same as other assets and liabilities.

Starting with fiscal years beginning after June 15, 2021, counties, municipalities, and school districts under GASB 87 will soon begin to account for most leases longer than 12 months on the front of the balance sheet, the same as other assets and liabilities.

The new reporting requirement from the Government Accounting Standards Board (GASB), which sets financial reporting standards for state and local governments, is part of a push for heightened transparency.

The following are some answers to commonly asked GASB 87 questions to help with your implementation:

What is the scope of GASB 87?

GASB 87 takes all leases – with few exceptions - and brings them over to the balance sheet as capital assets and lease liabilities for any statements that report on the full accrual basis of accounting. For entities that report in accordance with GAAP, this would include the Government-wide Statement of Net Position and the Proprietary Statement of Net Position.

For leases a year or more in length, the change essentially eliminates the category of operating leases – those contracts typically awarded for day-to-day functioning.

Additionally, GASB 87 is retroactive, meaning governmental entities must show every lease on their balance sheet that has been entered to in prior years that is still active. Financial statements must look backward and forwards. The lease's full life must appear on the balance sheet from its origin to its final contracted year.

What level of detail is required?

Leases of more than a year need to show the following detail:

- Overall lease asset and liability

- Amortization expense from using up the leased asset during the lease

- Periodic interest expense on the lease liability

The change also impacts leased income received by local governments or school districts. While not typically in the business of leasing out either property or equipment, if such agreements are in place, you need to show the following details:

- A receivable for the right to receive payments

- A corresponding deferred inflow of resources

- Lease revenue reported systematically over the lease term

- Periodic interest revenue from the receivable

Note: If you cannot find your lease payment schedules that break out each of your leases' principal and interest, we suggest reaching out to the vendors to get the information – you will need this at audit time.

How does the new lease accounting look in practice?

The need to look backward and forward when accounting for leases under GASB 87 can be tricky. You may have to post prior period adjustments for existing leases and determine asset values and how much liability is still outstanding (if material).

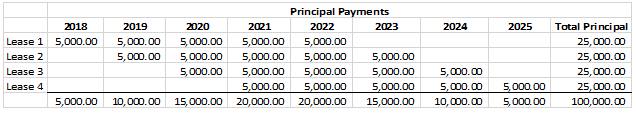

Let’s look at a series of $25,000, five-year leases for 2018 through 2025 taken by a local municipality for copiers and other previous operating leases. Assuming the value of every year’s outlay is a prorated $5,000, each $5,000 must be entered on the balance sheet, starting with that initial 2018 contract and looking toward the 2022 conclusion.

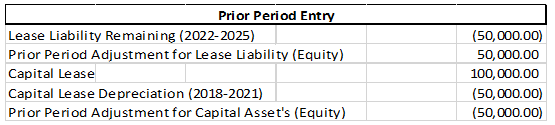

For simplicity, the example assumes the lease's annual depreciation matches the remaining value of the liability. Given this information and the above chart, the entries for the fiscal or calendar year ended 2022 will be as follows:

The prior period lease liability comprises future payments after the fiscal or calendar year end 2021. The prior period adjustment for capital leases is the total principal value of the assets. As mentioned, the depreciation is posted in this situation to match the asset.

After you post this entry, the yearly entries for payments start in fiscal year end/calendar year end 2022 as they would for other previous capital leases.

What are my immediate steps?

Most government entities hold a large and varied number of leases. Spaces, equipment, and supplies are acquired and managed through leases.

Government finance officers and business managers can take two necessary steps to prepare for the moment when an auditor or accountant comes through the door:

- Gather documentation for all active leases and had at least one payment in calendar or fiscal year end 2022, plus all leases moving forward. Reflect all phases, past, present, and future. Remember that the distinction between capital and operating leases is gone.

- As noted earlier, if lease payment schedules that break out principal and interest of any leases are not in your files, contact vendors to obtain them.

By compiling the necessary materials in advance – perhaps using an Excel spreadsheet – you can avoid headaches when preparing statements and getting ready for audits.

Bottom line

The new accounting rules mean leases will now be on your balance sheet with the rest of listed debts. GASB 87 does add a layer of complexity to the already painstaking task of preparing financial reports. At Boyer & Ritter LLC, our governmental specialist team is ready to provide the guidance you need to navigate these new requirements successfully.

Please contact the firm’s Government Services Group at 717-761-7210 or info@cpabr.com