New IRS guidelines make employee parking a taxing ordeal

by Brian J. Kutz

by Brian J. Kutz

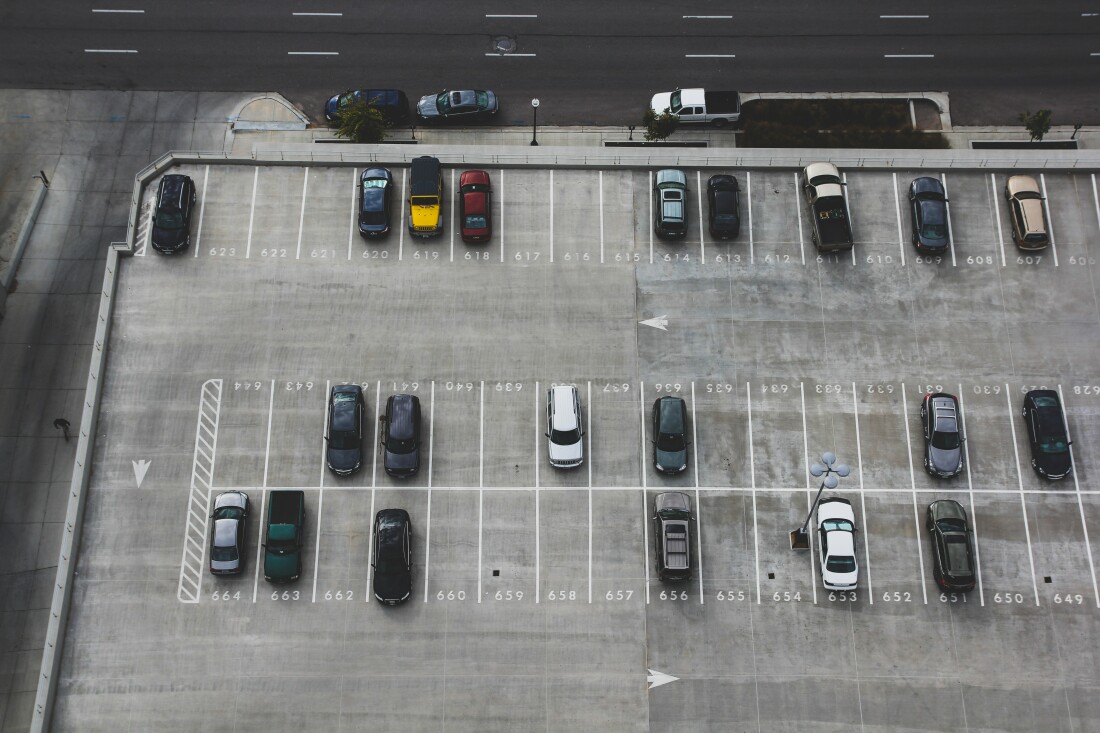

Employers that provide parking to their employees may be in for a nasty surprise this tax season.

A provision of the Tax Cuts and Jobs Act of 2017 (TCJA) disallows parking expenses incurred by employers that provide parking to their employees. On the nonprofit side, organizations are required to increase their Unrelated Business Taxable Income (UBTI) for any expenses disallowed under this provision.

Every employer providing parking to their employees must consider this new expense disallowance.

The Basics

Employee parking includes “parking provided to an employee on or near the business premises of the employer or on or near a location from which the employee commutes to work.” Employers will have to calculate an adjustment if either or both of the following conditions are met:

- The employer has parking spots specifically reserved for employee use

- The employer has a parking lot where the primary use is for employee parking

Are there any reserved employee spots?

If the employer has parking spots specifically reserved for employee use, there will be expenses disallowed regardless of the primary use of the lot. Examples of ways spots may be reserved for employee use include specific signage (i.e. Employee Use Only), a separate facility, or a portion of a facility segregated by a barrier or limited in terms of access.

The IRS provides one piece of good news related to reserved employee spots: Employers have until March 31, 2019 to unreserve those spots, and it will apply retroactively to January 1, 2018.

Primary Use Test and a Potential Safe Harbor

You also need to apply the primary use test to determine if you are subject to this provision. If the primary use of the parking spots available is to provide parking to the general public, then the parking expenses associated with the parking facility are not subject to any disallowance. For purposes of these rules, primary use means greater than 50 percent of the actual or estimated usage of the parking spots in the parking facility during normal business hours on a typical business day.

Complexity in Calculation and Public Pressure to Repeal

Within the primary use test, there are different layers of nuance related to which spots are considered available for the general public versus which spots are considered employee parking. For example, partners, 2-percent shareholders of S Corporations, sole proprietors, and independent contractors are not considered employees nor general public for purposes of the primary use calculation. Additionally, if spots are typically empty on an average business day and they are available to the public, they will count as general public parking. Effectively, the IRS guidance requires consideration of a lot of moving pieces to determine if you meet the primary use test safe harbor.

If you are not protected by the safe harbor, you will have to perform a complex calculation to determine the amount of qualified parking expenses disallowed. Total parking expenses include, but are not limited to, repairs, maintenance, utility costs, insurance, property taxes, interest, snow and ice removal costs, leaf removal costs, trash removal costs, cleaning and landscaping, parking lot attendant or security costs, and rent or lease payments associated with the parking facility. Because of the complexity of the calculation and the widespread application, there has been an outcry to repeal this provision. However, until further guidance is issued, many employers will have to face the complexity of its application.

Bottom Line

If you have any reserved employee spaces, you have until March 31, 2019 to unreserve those spaces and have it applied retroactively to the beginning of 2018. If you continue to have reserved employee spaces or the primary use of the parking facility is for employee use, you will have to perform a calculation to determine the disallowed parking expense.

There are still a lot of unanswered questions surrounding this issue. Both the calculation of the safe harbor as well as the calculation of the disallowed expenses are complex. It would be prudent to consult with your tax advisor to ensure that these items are being considered correctly.

Brian J. Kutz is a tax supervisor with Boyer & Ritter LLC who provides services for businesses and individuals and has worked with clients in various industries. Contact Brian at 717-761-7210 or bkutz@cpabr.com