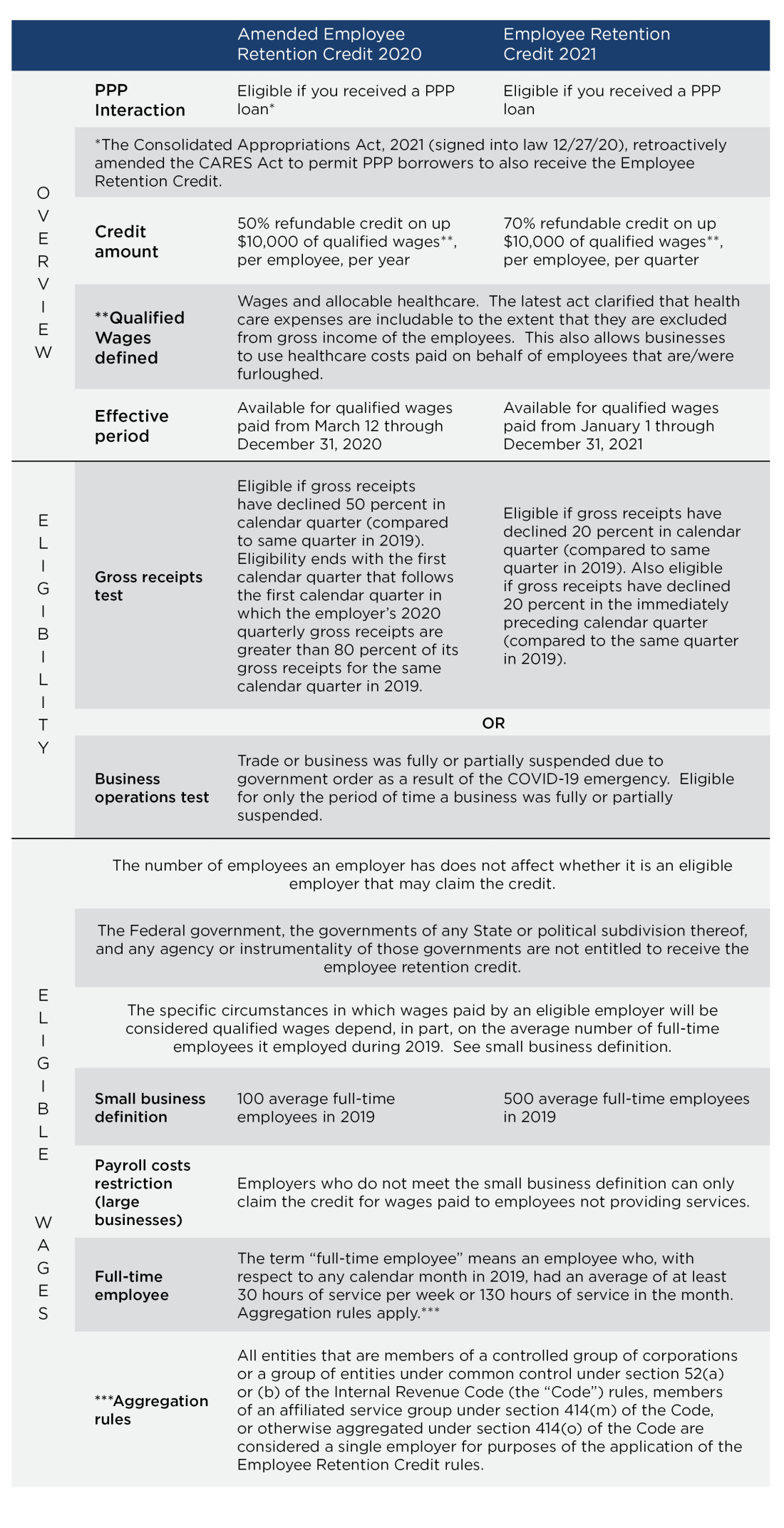

Quick Reference Guide for ERTC Relief

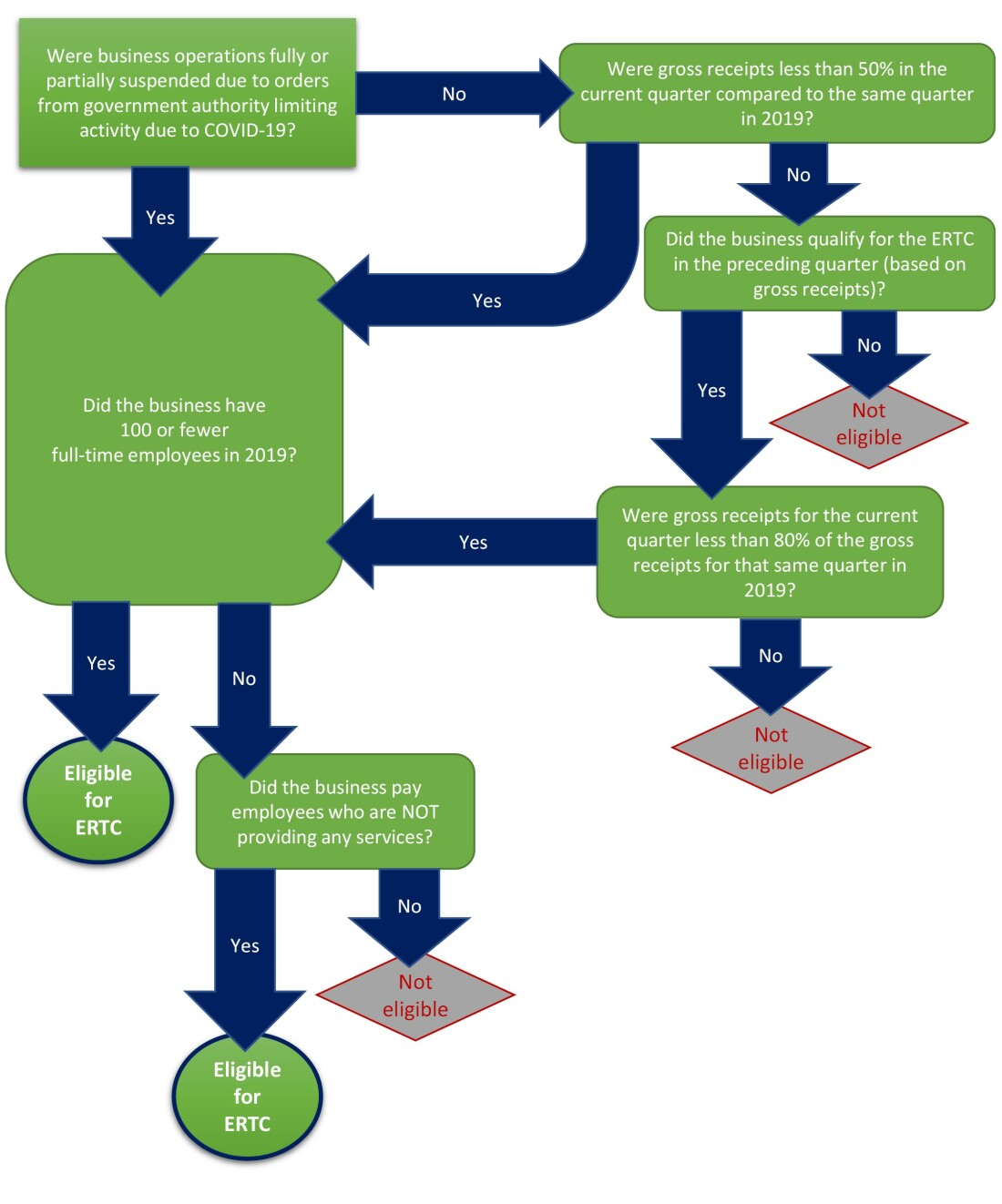

Employee Retention Tax Credit Decision Tree for 2020 quarters

The following decision tree diagram is intended for use in assisting for determining your ERTC eligibility during a quarter of 2020. Refer to the chart above for the definition of full-time employees. This is provided for informational purposes and does not constitute accounting or legal advice. You should seek accounting, financial and/or legal advice as appropriate to your situation.

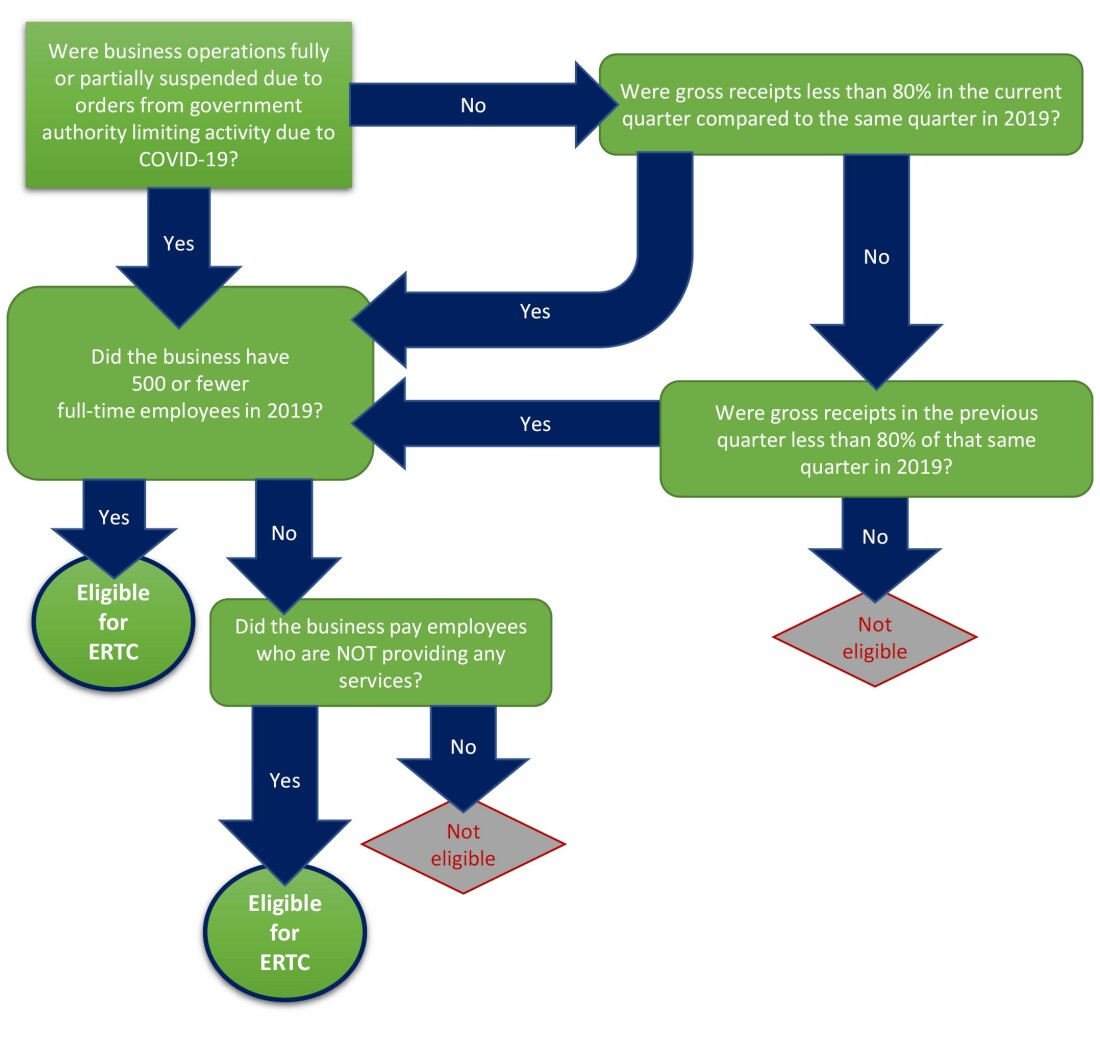

Employee Retention Tax Credit Decision Tree for 2021 quarters

The following decision tree diagram is intended for use in assisting for determining your ERTC eligibility during a quarter of 2021. Refer to the chart above for the definition of full-time employees. This is provided for informational purposes and does not constitute accounting or legal advice. You should seek accounting, financial and/or legal advice as appropriate to your situation.

Related Article: Employee retention tax credits could create significant cash flow for businesses

To view and download the full quick reference guide for ERTC relief, click here.